By Alix Machiels, Maria Aman, International Labour Organization (ILO)

(c) UNICEF/0791790/Mojtba Moawia Mahmoud

In April 2023, a technical exchange brought together experts and practitioners to share experiences and lessons learned from the extension of social protection to workers in the informal economy.

Co-organized by the Global Partnership to achieve universal social protection (USP2030) and the EU funded Social Protection and Public Finance Management (SP&PFM) Programme, the event showcased country experiences on extension strategies to lift barriers to coverage. Discussions highlighted the need to promote transitions to formality, in alignment with key principles of solidarity and collective financing. Watch the recordings and access resources and materials here.

The majority of those without coverage are in the informal economy

Although it has been recognized as a human right, today, more than 4 billion people still do not have access to social protection (ILO 2021d). The COVID-19 pandemic and its economic and social consequences, then austerity measures and the cost-of-living crises, have paused or reversed progress that had been achieved in recent years towards adequate and comprehensive coverage.

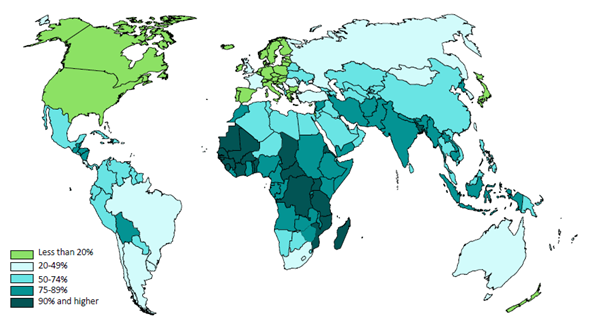

The overwhelming majority of those without coverage are in the informal economy, which itself represents 61.2% of the world’s employed population (ILO 2021b). Therefore, making universal social protection a reality is not possible without extending social protection mechanisms to workers in the informal economy and facilitating their transition to the formal economy.

Figure 1: Percentage of informal employment in total employment (%), 2019. Source: (ILO 2023b)

Reaching informal workers requires comprehensive extension strategies

Achieving social protection for all requires the development of evidence-based and participatory national extension strategies that respond to workers’ specific circumstances. For example, in Senegal, a sector-wise diagnostic on the situation of economic units and workers in the informal economy (ILO, 2020) led to the launch of a scheme for micro and small enterprises and their workers, addressing their priority needs and tailored to their contributory capacity (ILO 2021a). This new scheme has registered more than 8,000 workers since its launch.

The participation of social partners in the formulation of such strategies is essential to ensure that benefits are adequate, affordable and attractive and accessible including for micro and small enterprises. In Cambodia, a Civil Society Organization-Trade Union network of more than 30 members took an active role in social protection policy development through evidence generation on contributory capacity (Oxfam, 2022) and direct dialogue with the government, development partners, social protection institutions and employers.

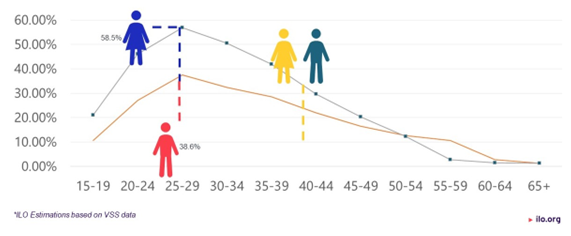

Women are more likely to find themselves in the informal economy than men, and therefore particular attention should be paid to ensuring that extension strategies promote gender equality and women’s empowerment. In Vietnam, for instance, women were found more likely to drop out of the social security system as they age (see graph below). Key recommendations for narrowing gender gaps in coverage and benefits (ILO 2021a) will provide for a more effective, efficient, gender-sensitive social security system.

Figure 2. Social insurance coverage of workers, by age and sex, Viet Nam, 2019 (percentage of the labour force). Adapted from ILO, 2021a.

Mechanisms should be tailored to the situation of various workers

The informal economy is highly heterogeneous and comprises a great variety of different workers and working situations, including workers working informally in formal enterprises, self-employed workers, agricultural workers, and domestic and care workers. This calls for the necessity to tailor existing mechanisms to the situation of different groups of workers through measures that address the specific barriers to coverage –legal, financial, and administrative— they face (ILO 2021b).

Legal frameworks may prevent or constrain the participation of certain categories of workers in social protection schemes. A lack of information and awareness on social security is another major barrier to registration (ILO 2021e). In Colombia, the government has taken measures to ensure better access to social security for migrant workers and refugees, including through an awareness-raising and information campaign, #RightsAlsoMigrate, targeted at workers and their employers. In Ethiopia, dialogue with organizations of workers and employers and media campaigns launched by the Private Organizations’ Employees Social Security Agency (POESSA) were key to enhancing compliance in micro and small enterprises.

Aligning benefits with the priority needs of those in the informal economy is another key lever for a successful extension (ILO 2021b). Workers and employers may be reluctant to contribute if they are not convinced that the benefits provided will meet their needs as well as those of their families, including children. Family-friendly social protection policies help address the specific working conditions and vulnerabilities for workers in the informal economy – and particularly for caregivers, a majority of which are women (UNICEF, ILO, and WIEGO 2021).

Administrative and financial barriers are also considerable obstacles. Informal employment is often characterized by low earnings and irregular income. Procedures are often costly, long and complex. Social security contribution levels can be perceived as too high, particularly by self-employed workers who cannot count on the support of an employer (ILO 2021c). Countries that have successfully extended coverage to self-employed workers have usually done so by simplifying procedures and ensuring affordable contribution levels, for instance through simplified and unified tax and social security regimes (ILO & WIEGO, forthcoming).

Figure 3. A street vendor selling fruit, Dakar, 14/01/2022. Photo by the ILO.

Extension strategies should promote transitions to formality

Uruguay’s monotax mechanism is a successful example of how combining income tax and social contributions into one single, affordable payment can encourage the formalization of enterprises and workers by simplifying procedures, offering attractive benefits, and ensuring that contribution rates are adapted to their contributory capacity (ILO 2014). Such experiences show how social security can act as a powerful incentive for formalization (Gaarder et al. 2021).

The extension of social protection mechanisms should promote transitions from the informal to the formal economy, through effective coordination with employment, tax, labour market, or health policies, multiplying positive impacts through synergies across policy areas. Such approaches trigger a virtuous cycle of productivity increases, more sustainable enterprises, better working conditions and access to progressively higher levels of protection for workers, unlocking a pathway to decent work (ILO 2021b).

Nepal, where registrations doubled over the past 2 years, took important steps towards a coordinated and integrated approach for formalization with the ‘Formalization Action Plan’ endorsed in August 2022. The plan highlights the extension of contributory social insurance mechanisms to informal workers and the self-employed as an important step towards the formalization of enterprises and workers in informal employment (ILO 2023a).

Integrated approaches to the extension of coverage and the formalization of enterprises and employment can also help create fiscal space for universal social protection systems by broadening the tax and contribution base, which can then be reinvested into social protection schemes and public services (ILO 2021b). Although this may initially require some degree of subsidization and investment in public institutions and services, over time, these approaches get the highest return on investment in terms of financial sustainability and adequacy of protection.

Strategies must be built on fundamental principles of solidarity and collective financing

To guarantee social security as a human right along with the right to work, health, food, and a standard of living, extension strategies must be built around fundamental principles of universal protection, adequate and predictable benefits, financial sustainability and solidarity-based collective financing.

To promote these principles, extension strategies should adapt existing schemes and mechanisms for different categories of workers in the informal economy. Creating separate or individual saving schemes carries the risk of fragmentation and insufficient risk-pooling. This is also often the case when voluntary mechanisms are used, which often fail to link people to larger risk pools that would allow for horizontal and vertical redistribution (ILO 2021b).

To guarantee at least a basic level of protection, the extension of contributory social protection coverage should be complemented by tax-financed mechanisms (ILO 2021b). This ensures that those who can contribute to social security do so while preventing low-income workers from being excluded. It promotes solidarity, ensures better risk pooling and more sustainable and equitable financing for social protection systems.

It is often argued that social protection systems that combine employment-related social insurance and tax-financed social assistance for low-income workers create perverse incentives, encouraging informality. However, there is good evidence that shows the weak empirical foundation of these arguments (WIEGO, 2023).

Much still needs to be done – but it is possible!

In the face of increasingly rapid changes, such as climate change, and emerging crises, including cost-of-living crises, it has become more important than ever to accelerate progress towards SDG 1.3, and help populations – including those in the informal economy – face intensifying life and socio-economic risks and shocks.

The technical exchange organized by the SPPFM programme and USP2030 provided a valuable opportunity to celebrate the progress achieved toward the extension of social protection to all and the formalization of informal employment globally. While universal coverage is still a work in progress, experiences shared provided a blueprint for future progress and showed that extending social protection to those in the informal economy can indeed be achieved.

This is the eight blog post in the USP2030 blog series. It was first published on 3 May 2023 on socialprotection.org

References

Gaarder, Edwin, Judith van Doorn, Christina Behrendt, and Quynh Anh Nguyen. 2021. ‘Enterprise Formalization: Tailored Registration, Tax and Social Security Requirements for MSEs’. Geneva: International Labour Organization.

ILO. 2014. ‘Uruguay – Monotax: Promoting Formalization and Protection of Independent Workers’. Social Protection in Action Country Brief. Geneva: International Labour Office.

——. 2020. Diagnostic de l’économie informelle au Sénégal. Dakar: International Labour Organization.

——. 2021a. ‘Adapting Social Insurance to Women’s Life Courses: A Gender Impact Assessment of Viet Nam’. Hanoi: International Labour Organization.

——. 2021c. ‘Extending Social Security to Self-Employed Workers: Lessons from International Experience’. Social Protection Spotlight.

——. 2021d. World Social Protection Report 2020–22: Social Protection at the Crossroads – in Pursuit of a Better Future. Geneva.

——. 2021e. ‘Extending Social Security to Workers in the Informal Economy Information and Awareness’. Social Protection Spotlight Brief.

——. 2023b. ‘Women and Men in the Informal Economy: A Statistical Update’.

ILO and WIEGO. Forthcoming. Inclusive social insurance – exploring real solutions to reach the self-employed.

Oxfam. 2022. Study report on contributory capacity of informal economy workers to National Social Security Fund.

UNICEF, ILO, and WIEGO. 2021. ‘Family-Friendly Policies for Workers in the Informal Economy: Protecting and Ensuring Social Protection and Care Systems for All Children and Families in the Context of COVID-19 and Beyond’.

WIEGO. 2023. Did Mexico’s Seguro Popular Universal Health Coverage Programme Really Reduce Formal Jobs? WIEGO Working Paper No 46. March 2023.